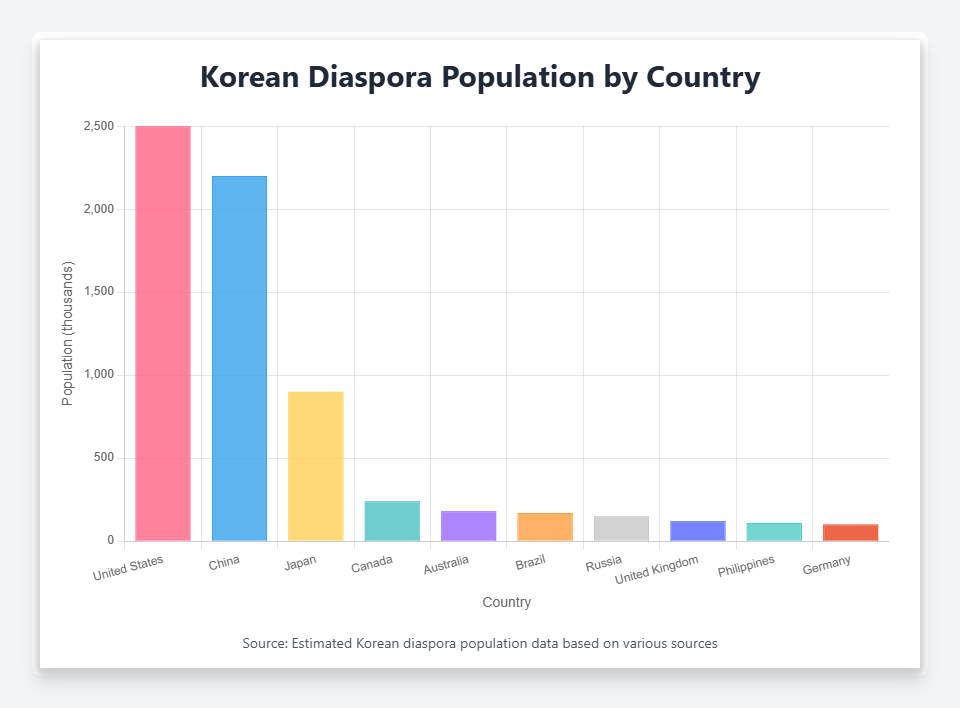

Korean Populations Aboard - Worldwide

Provided by various opendata sources in 2023

Facts of Korea and Korean

Korea is located in north east side of Asia. It has been called the Korean Peninsula which shares most of northern border with China and a small portion of Russia. The other three sides of Its borders are facing sea. from southern most border of Korea, Japan lies about 150kms away. The total distance of the Korean Peninsula is about 1000 kilometers (625miles) north to south. The total area of the peninsula is 222,154 square km. The south part of the peninsula, Republic of Korea, is about 99,392 square km. Location is between latitudes 33 and 43 degree North & longitudes 124 and 131 degree East.

Korea has four distinct seasons and a variety of weather types. Spring and autumn are short, and very pleasant with crisp weather. Korea has hot, humid summer with rainfalls. Winter is cold and dry with many snow. read more facts of korea ...

The land of the Morning calm

Korea has been know as “ The land of the Morning calm” for generations. For centuries the Korean peninsula was dominated by larger, more aggressive neighbors like America, Russia, China, and Japan because of it’s geographical reason. Even though Korea has been overrun and conquered by outsiders.

It maintain it's history and culture for 5000 years

Korea has been know as “ The land of the Morning calm” for generations. For centuries the Korean peninsula was dominated by larger, more aggressive neighbors like America, Russia, China, and Japan because of it’s geographical reason. Even though Korea has been overrun and conquered by outsiders.

It maintain it's history and culture for 5000 years

The Korean alphabet, "Han Gul", has been used as official Korean Language. The fact that Koreans speak and write the same language has been a crucial factor in Korea's strong national identity.

learn more about Korean history...

Early Korean History

The Korean people share a common heritage in spite of the modern-day split between North and South Korea. Human habitation of the Korean Peninsula dates back 500,000 years. Excavations have found pottery and stone tools from Neolithic-age settlements ca. 4000

The Korean people share a common heritage in spite of the modern-day split between North and South Korea. Human habitation of the Korean Peninsula dates back 500,000 years. Excavations have found pottery and stone tools from Neolithic-age settlements ca. 4000

- Three Kingdoms

- Koryo Dynasty

- Chosun Dynasty

- Japanese Occupation

- the Korean War(1950) and Divided Nation

Modern Korean History

Postwar South Korea: In 1952 Syngman Rhee, who had assumed the presidency of South Korea in 1948 after election by the National Assembly, was elected president by popular vote. Rhee’s presidency was characterized by efforts to cling to power, and the 1950s were a time of economic and social hardship in South Korea. Rhee’s increasingly corrupt efforts to remain in office reached their nadir in the 1960 elections. The obvious malfeasance at work in that vote led to widespread protest, known today as the April 19 Student Revolution. Rhee was forced, at last, to step down. In the interim until new elections, political instability and the absence of a clear successor to Rhee, among other factors, laid the foundations for the military coup that followed. In 1961 a group of military officers loyal to Major General Park Chung Hee carried out a coup. Post War South korea ...

Postwar North Korea: Kim II Sung’s regime established a socialist command economy, with priority development on heavy industry. Agriculture was collectivized. A Marxist-Leninist political model of autonomy and self-reliance—called chuch’e (sometimes rendered juch’e)—was popularized starting in 1955 as the guiding ideology in politics, economics, national defense, and foreign policy. By 1956, Kim Il Sung had achieved unchallenged supremacy in the KWP. With tight control over all aspects of the North Korean polity and society, Kim Il Sung became the “Great Leader” and the object of a pervasive personality cult. Post War North korea ...

Korean Traditional Culture

Over the couse of thousands of years, Korea has develped an incredibly rich variety of cultural and artistic expresion. In addition, it has blended foreign influences, especially Chinese, with indigenous elements to creat unique beliefs, ways of living, literature and hanicrafts. In more modern times, Western influences have been added to the mixture to careate a sometimes heart-stopping blend of old and new, contrasts and juxtapositions in the texture of Korean life.

- Traditional Crafts

- Pottery

- Calligraphy: The Art of the Scholar

- Traditional Painting

- Sculpture

- Architecture

Korean Language (HanGul) 한글

Korean is the national language and is spoken in a variety of local dialects generally coinciding with provincial boundaries. The Seoul dialect is the basis for modern standard Korean. Written Korean uses Han’gul, the Korean phonetic alphabet developed in the fifteenth century by King Sejong. Chinese characters (Hanja), once used exclusively by the literati, occasionally still are used. English is also widely taught in schools.

The Korean alphabet, which is considered one of the most scientific writing systems in use in the world, consists of 10 vowels and 14 consonants, which can be combined to form numerous syllabic groupings. It is simple but sytematic and comprehensive at the same time. Hangul is easy to learn and print which has greatly contributed to Korea's high literacy rate and advanced publication industry. it is also easily appliable to computer systems.

Korean Alphabet

14 Consonants: ㄱ ㄴ ㄷ ㄹ ㅁ ㅂ ㅅ ㅇ ㅈ ㅊ ㅋ ㅌ ㅍ ㅎ

10 Vowels: ㅏ ㅑ ㅓ ㅕ ㅗ ㅛ ㅜ ㅠ ㅡ ㅣ

Korean Alphabet

모음 (Vowel) |

ㅏ(a) | ㅑ(ya) | ㅓ(uh) | ㅕ(yuh) | ㅗ(oh) | ㅛ(yo) | ㅡ (eu) | ㅣ(ii) |

|---|---|---|---|---|---|---|---|---|

| ㄱ(G) | 가(Ga) | 갸(Gya) | 거(Guh) | 겨(Gyuh) | 고(Goh) | 교(Gyo) | 그(Geu) | 기(Gii) |

| ㄴ(N) | 나(Na) | 냐(Nya) | 너(Nuh) | 녀(Nyuh) | 노(Noh) | 뇨(Nyo) | 느(Neu) | 니(Nii) |

| ㄷ(D) | 다(Da) | 댜(Dya) | 더(Duh) | 뎌(Dyuh) | 도(Doh) | 됴(Dyo) | 드(Deu) | 디(Dii) |

| ㄹ (between L and R) | 라(La) | 랴(Lya) | 러(Luh) | 려(Lyuh) | 로(Loh) | 료(Lyo) | 르(Leu) | 리(Lii) |

| ㅁ (M) | 마(Ma) | 먀 Mya) | 머(Muh) | 며 (Myuh) | 모 (Moh) | 묘 (Myo) | 므 (Meu) | 미(Mii) |

| ㅂ (B) | 바 (Ba) | 뱌 (Bya) | 버(Buh) | 벼(Byuh) | 보(Boh) | 뵤(Byo) | 브 (Beu) | 비(Bii) |

| ㅅ (S) | 사 (Sa) | 샤 (Sya) | 서 (Suh) | 셔 (Syuh) | 소 (Soh) | 쇼 (Syo) | 스 (Seu) | 시 (Sii) |

| ㅇ (- / ng) | 아 (a) | 야 (ya) | 어 (uh) | 여 (yuh) | 오 (oh) | 요 (yo) | 으 (eu) | 이 (ii) |

| ㅈ (G, J) | 자 (Ja) | 쟈 (Jya) | 저(Juh) | 져 (Jyuh) | 조 (Joh) | 죠 (Jyo) | 즈 (Jeu) | 지 (Jii) |

| ㅊ (CH) | 차(Cha) | 챠 (Chya) | 처 (Chuh) | 쳐 (Chyuh) | 초 (Choh) | 쵸 (Chyo) | 츠 (Cheu) | 치 (Chii) |

| ㅋ (K) | 카 (Ka) | 캬 (Kya) | 커 (uh) | 켜(Kyuh) | 코 (Koh) | 쿄 (Kyo) | 크 (Keu) | 키(Kii) |

| ㅌ (T) | 타 (Ta) | 탸 (Tya) | 터(Tuh) | 텨 (Tyuh) | 토 (Toh) | 툐 (Tyo) | 트 (Teu) | 티 (Tii) |

| ㅍ (P) | 파 (Pa) | 퍄 (Pya) | 퍼 (Puh) | 펴 (Pyuh) | 포 (Poh) | 표 (Pyo) | 프 (Peu) | 피 (Pii) |

| ㅎ (H) | 하 (Ha) | 햐 (Hya) | 허 (Huh) | 혀(Hyuh) | 호 (Hoh) | 효 (Hyo) | 흐 (Heu) | 히 (Hii) |

Learn more Korean Beginner(초급)| Intermediate (중급) | Advanced (고급)

Type using MS Korean IME (한글자판)

Korean Traditional Food

The easiest and most enjoyable way to enter a new culture is through its food. So you can't name the cabinet members of a given country, but you can instantly name its most famous dish. And though we recognize some associations as steerotypes, they allow us to identify with the people of that community more than any other aspect of culture. Perhaps this is because everyone has certain strongly held associations about food, which are memarkably similar throughout the world. A typical Korean meal includes a bowl of rice, soup, vegetables, and either fish, tubu or meat and Kimchi...

The easiest and most enjoyable way to enter a new culture is through its food. So you can't name the cabinet members of a given country, but you can instantly name its most famous dish. And though we recognize some associations as steerotypes, they allow us to identify with the people of that community more than any other aspect of culture. Perhaps this is because everyone has certain strongly held associations about food, which are memarkably similar throughout the world. A typical Korean meal includes a bowl of rice, soup, vegetables, and either fish, tubu or meat and Kimchi...

Typically, Major dish of Korea is KimChi and you would not be wrong if you assumed that most Koreans eat Kimchi in one form or another everday. Kimchi is general term for a pickled vegetable side dish, made of Chinese cabbage, radish, cucumbers or seafood, and red peppers. Kimchi is but one of many side dishes that accompany rice. Since all the dishes are presented together on a table, Korean etiquette does not require a specific order in eating. Traditionally, the number of dished indicated the position of both the household and the guest.

Places to Visit

- Seoul : Capital of South Korea. World 10th Lagest City.

- Korean Folk Village : A traditional village for tourists located about 30 mins south of Seoul, reenacts of ancient Korean life.

- Panmunjum : A 56 Km bus trip to north, it is joint security area managed by the UN command and North Korean guards.

- Kyongju : The ancient capital of the Shilla Kingdom for a thousand years. Royal tombs, Temple sites with pagodas and buddhist temple, like Pulguksa.

- Cheju-do Island : Korea's only island province is about one hour by air from Seoul. Semi tropical climate with Mt. Hallasan, an extinct volcano with a large crater.

- Mt. Sorak and East Coast Resorts : The northern stretch of Korea's east coast. Skiing and other winter sports. Considered one the the Korea's most spectacular mountain.

- North Korean Cities to Visit : PyongYang, ShinEuJu, GaeSung, HamHung